Strengthen Your Building: Proficiency in Trust Foundations

Strengthen Your Building: Proficiency in Trust Foundations

Blog Article

Guarding Your Possessions: Trust Structure Competence at Your Fingertips

In today's intricate financial landscape, ensuring the safety and security and development of your possessions is extremely important. Trust fund foundations serve as a cornerstone for protecting your wealth and tradition, offering a structured technique to possession security.

Value of Depend On Structures

Depend on structures play a vital duty in developing integrity and cultivating solid connections in different expert settings. Building trust is essential for businesses to grow, as it creates the basis of effective partnerships and partnerships. When trust is existing, people really feel much more confident in their communications, bring about boosted efficiency and efficiency. Trust structures act as the cornerstone for ethical decision-making and clear communication within organizations. By focusing on count on, companies can develop a favorable work society where workers feel valued and valued.

Benefits of Professional Support

Structure on the structure of depend on in specialist partnerships, looking for professional support uses vital advantages for people and organizations alike. Professional assistance offers a wealth of knowledge and experience that can assist browse complex economic, lawful, or calculated obstacles effortlessly. By leveraging the expertise of experts in numerous areas, individuals and organizations can make enlightened decisions that align with their goals and aspirations.

One substantial benefit of specialist guidance is the ability to accessibility specialized understanding that may not be readily available otherwise. Professionals can offer insights and viewpoints that can bring about cutting-edge options and chances for growth. In addition, working with experts can aid reduce risks and unpredictabilities by offering a clear roadmap for success.

Furthermore, specialist support can save time and sources by improving procedures and preventing pricey errors. trust foundations. Specialists can provide personalized recommendations tailored to certain requirements, making certain that every decision is educated and tactical. On the whole, the benefits of specialist guidance are diverse, making it a valuable possession in guarding and optimizing assets for the long-term

Ensuring Financial Protection

Making sure monetary safety and security involves a multifaceted approach that incorporates numerous elements of riches management. By spreading financial investments throughout different asset courses, such as supplies, bonds, genuine estate, and commodities, the risk of substantial monetary loss can be reduced.

Additionally, keeping a reserve is vital to protect versus unanticipated costs or income disturbances. Professionals recommend reserving 3 to 6 months' worth of living expenditures in a liquid, easily accessible account. This fund serves as a financial safety and security internet, providing assurance during stormy times.

Frequently reviewing and readjusting financial strategies in reaction to transforming situations is also vital. Life events, market changes, and legislative modifications can influence monetary security, underscoring the relevance of ongoing examination and adaptation in the search of long-term monetary security - trust foundations. By executing these approaches thoughtfully and regularly, people can strengthen their financial ground and job towards a much more safe and secure future

Protecting Your Properties Effectively

With a solid structure in position for financial safety via diversification and emergency fund maintenance, the following critical step is protecting your possessions effectively. Protecting possessions includes shielding your wealth from potential risks such as market volatility, economic slumps, legal actions, and unpredicted expenses. One effective technique is possession allotment, which involves spreading your financial investments across numerous asset classes to reduce risk. Diversifying your portfolio can help reduce losses in one area Recommended Reading by stabilizing it with gains in another.

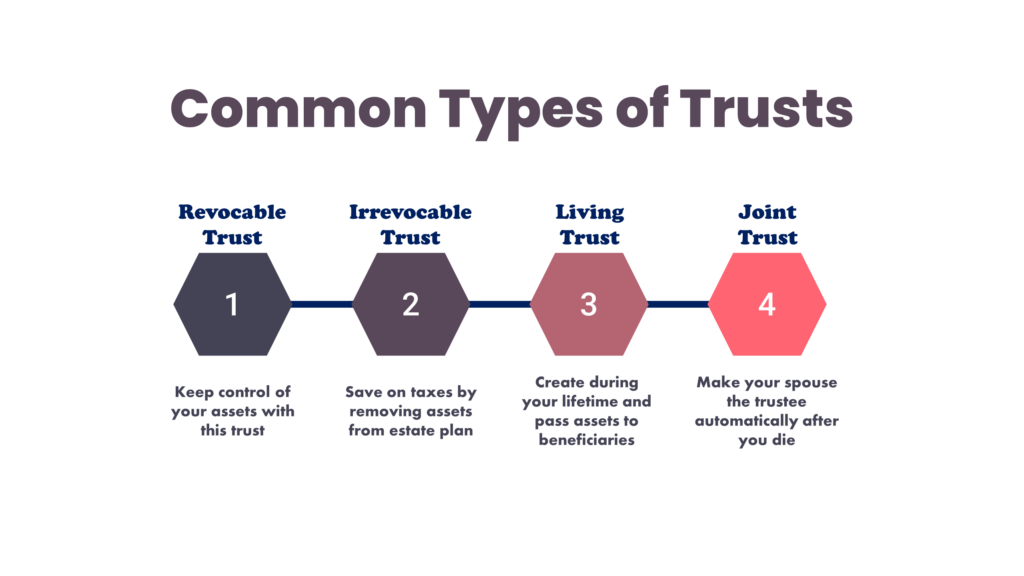

Furthermore, establishing a depend on can provide a safe way to safeguard your assets for future generations. Trust funds can help you regulate exactly how your assets are dispersed, reduce estate tax obligations, and safeguard your wide range from creditors. By applying these techniques and looking for professional recommendations, you can safeguard your possessions effectively and protect your economic future.

Long-Term Asset Defense

To guarantee the long-term safety and security of your wide range against prospective threats and uncertainties gradually, critical planning for long-lasting property defense is vital. Lasting property protection includes applying measures to protect browse around here your properties from numerous threats such as economic slumps, legal actions, or unanticipated life events. One important element of lasting property defense is developing a count on, which can provide considerable benefits in securing your properties from financial institutions and lawful disputes. By moving possession of assets to a trust, you can protect them from potential risks while still keeping some level of control over their administration and distribution.

Moreover, expanding your financial investment portfolio is another vital method for long-lasting asset defense. By spreading your financial investments across various about his possession classes, sectors, and geographical areas, you can lower the impact of market variations on your general wealth. In addition, on a regular basis examining and updating your estate strategy is necessary to ensure that your properties are safeguarded according to your wishes in the lengthy run. By taking a proactive strategy to long-lasting property defense, you can guard your wealth and supply economic safety and security for yourself and future generations.

Final Thought

In conclusion, trust foundations play an essential function in securing possessions and making certain economic protection. Specialist advice in developing and taking care of depend on frameworks is necessary for long-lasting possession security.

Report this page